Career Advancement Costs

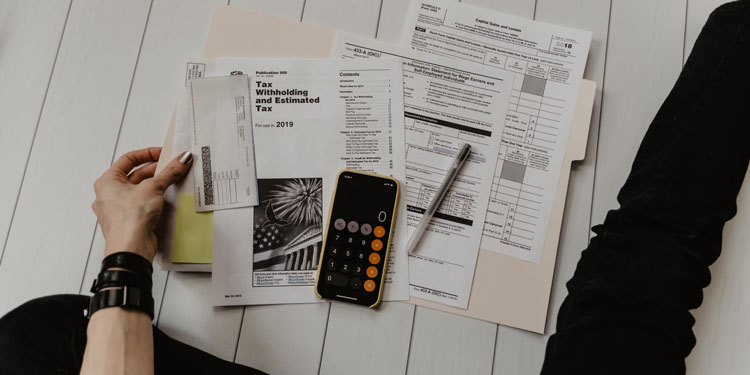

What are Career Advancement Costs? Many people are looking for professional growth but are not aware of the costs associated with it. Advancing your career might require further education, networking, or mentorship which can all have costs associated with them. Learn more about career advancement costs to determine if they’re worth the investment. Furthering Your […]

View Full Article