Can a Budgeting App Help You & Which to Choose?

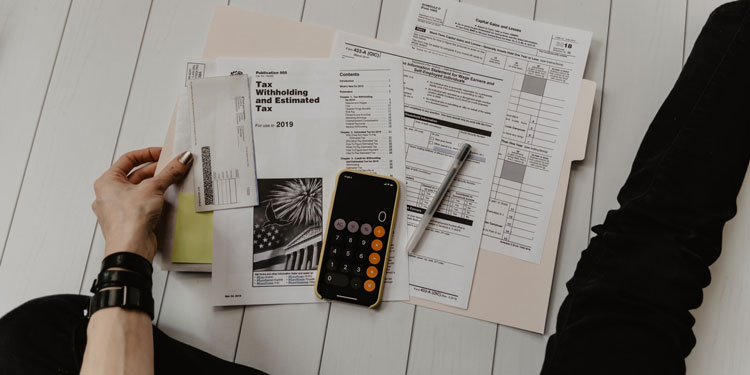

How to know if a budgeting app is right for you. Creating a budget for your household can be challenging, especially if finances are tight. Deciding which expenses to keep and what to cut can feel overwhelming. In addition, not everyone feels comfortable using Excel or a worksheet. However, creating a budget is vital to […]

Read More