Avoid These Common Money Habits to Save Your Wallet

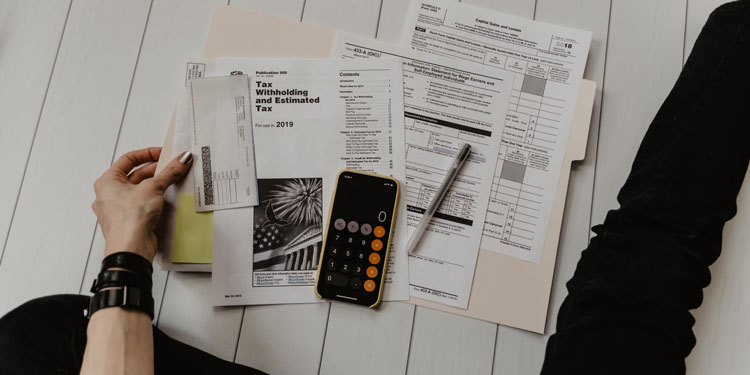

Learn what money habits are draining your bank account. You might be aware of expensive habits, but are you aware of the small ways you are neglecting your finances? Minor spending here and there could be preventing you from reaching financial goals, or even worse, causing you to accumulate debt. Here are some bad money […]

View Full Article