How to Address Shrinkflation

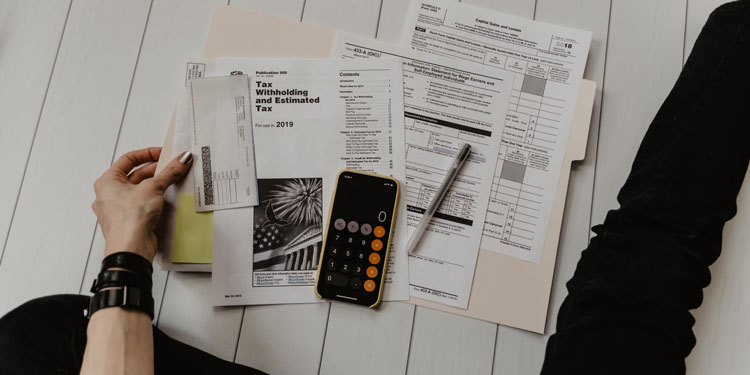

How to adjust your budget for shrinkflation. Shrinkflation has been on the minds of many Americans lately. In a recent survey, about 64% of adults surveyed said they are worried about it. Both shrinkflation and inflation are happening at the same time, meaning Americans are spending more for less on the items they use daily. […]

View Full Article